Fueling the Future:

How GN secured $13MM in flexible Capital

“ ”

The Whitehorn team are experts at managing complex financing transactions. We were impressed with their willingness and patience to understand GN’s unique transaction needs. They helped us prepare for the transaction and clearly communicated what to expect.

Greg and Ray worked with us from start through to funding and were fully committed during the process. They brought several term sheets in for us to consider and worked with our requests to negotiate a financing structure that provided the comfort and flexibility needed for GN’s continued growth.

James Elliott, GN Corporations CFO

Industry: Diversified Manufacturing

Deal Type: Growth & Working Capital Financing

Outcome: Obtained flexible liquidity to meet growth demand from new sectors

Company Background:

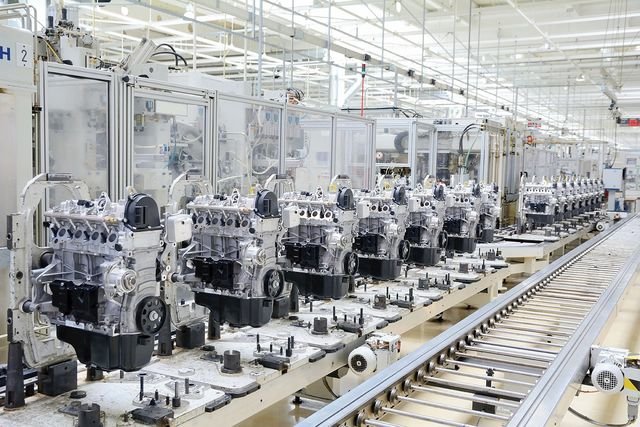

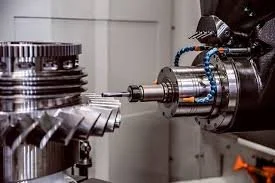

GN is a family-owned tier one CNC machining & manufacturing company serving the energy, automotive, aerospace, defense, technology and agriculture sectors. GN provides an integrated solution to its customers including assembly, fabrication, testing & inspection, coating & surface protection, heat & surface treatment. The Company operates out of a 114,475 sq. ft. facility in Airdrie, AB.

Navigating Liquidity During Growth Phase:

The demand for GN’s expertise and capabilities were growing quickly and GN required more flexibility to meet working capital demands in both Canada and the U.S.

GN’s “standard box” lender no longer fit its needs and management felt held back by a leash. In addition, management was dreading the endless requests for data, distraction from operations, and the fear of being “pigeonholed” into a bad deal.

How Whitehorn Delivered Value:

Total Market Access: Instead of settling for the first offer, Whitehorn explored a variety of customized solutions from various Canadian and U.S. lenders. This put GN in the driver’s seat to find the perfect partner who understood the nuances of its operations and prioritized its longer term vision.

Protection of Time: Management was able to remain focused on operations during this phase of immense growth with potential new customers from various sectors. Whitehorn stepped up to manage the complex machinery of due diligence, negotiations, and legals behind the scenes.

Peace of Mind: The final structure was not just about rate, more importantly it was about flexibility. The financing secured provided flexible liquidity as GN pursued growth, ensuring they did not have to hit the brakes on new opportunities.

< Back to all deals

If you are a Western Canadian business owner navigating growth or transition, Whitehorn is your advocate who understands that your business is more than just a balance sheet.